First-of-its-kind $12 parcel tax proposed for all nine Bay Area counties

By Paul Rogers progers@mercurynews.com

Posted: 01/13/2016

In a milestone for San Francisco Bay restoration that also raises questions about who should pay to protect property from rising seas caused by climate change, a low-profile government agency is expected to place a $12 annual parcel tax on the June ballot in all nine Bay Area counties.

The measure, whose campaign is being bankrolled by Silicon Valley business leaders and Bay Area environmental groups, is believed to be the first local tax ever placed before voters in all nine Bay Area counties.

If approved by two-thirds of voters, the tax would raise $500 million over the next 20 years to build levees and restore thousands of acres of wetlands and tidal marshes as a buffer to storm surges and floods in every Bay Area county.

"The bay is a beautiful asset we all want to protect and restore," said Carl Guardino, CEO of the Silicon Valley Leadership Group, which represents 390 large technology companies and other employers. "We are also concerned about the risk of sea level rise over time, or a storm that could cause flooding in unprecedented fashion. Either way we want to be prepared for it."

The leadership group, along with Save the Bay and the Bay Area Council, a business

group, already has raised $700,000 toward a campaign and plans to raise up to

$5 million. Influential leaders such as Robert Fisher of the Gap and John Doerr,

a Silicon Valley venture capitalist, already have donated to the campaign.

Advertisement

On Jan. 13 at 1 p.m., the San Francisco Bay Restoration Authority, a seven-member board created in 2008 by state lawmakers, will meet in Oakland at the headquarters of the state Coastal Conservancy. The authority will vote on whether to place the measure on the June 7 election ballot in Alameda, Contra Costa, Marin, Napa, San Mateo, Santa Clara, Solano, Sonoma and San Francisco counties.

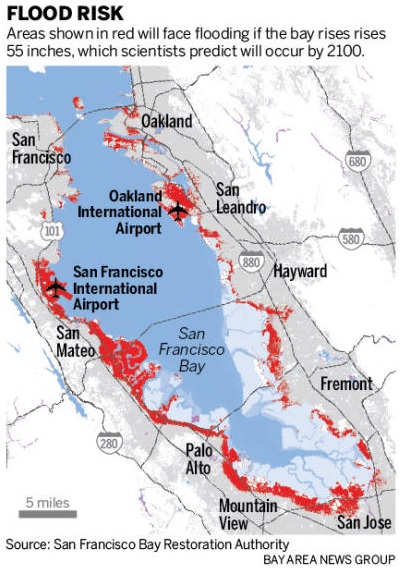

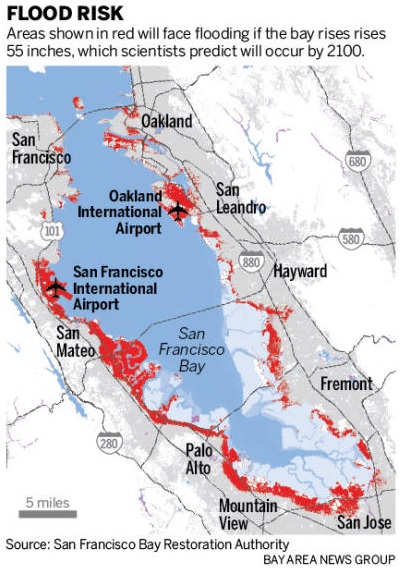

Studies done by the Bay Area Council and other organizations show that 270,000 residents, 1,780 miles of road and highways, and a combined total of 89 schools and health care facilities near the bay's shoreline are at risk of catastrophic flooding from a 100-year flood and sea level rise. Other areas that computer models indicate could be flooded include the Oakland and San Francisco airports, communities along the Marin waterfront, Highway 101 through the Peninsula, and the headquarters of at least 20 major technology companies in San Mateo and Santa Clara counties, including Google, Oracle, Facebook, Yahoo and Cisco.

The unique tax raises complex questions, however.

Since the $12-per-parcel tax will apply to all property owners in the nine counties, will people who live far away from the bay, such as residents of Cloverdale, Gilroy, Half Moon Bay or Livermore be willing to vote yes?

Will opponents be able to write different language in the ballot pamphlets of each county to tailor their message to local concerns? Will homeowners be willing to open their wallets to fund a measure that not only protects wildlife but also protects some of the richest companies on Earth?

"You have big companies like Apple that will only pay $12 per parcel," said Jon Coupal, president of the Howard Jarvis Taxpayers Association. "I respectfully suggest that Apple can afford the $12.

"You have large businesses trying to spread the burden to other taxpayers. If this were structured as a benefit assessment district, the properties closer to the bay would have to pay more."

Guardino contends, however, that not only do major companies employ tens of thousands of workers, the costs should be spread widely because public assets -- freeways, schools, sewage treatment plants, airports and hospitals -- are at risk. And internal polling by supporters found that more people said they are likely to vote yes on a parcel tax than a property tax that would be based on the value of each parcel.

A telephone poll of 1,505 people commissioned in December by the Restoration Authority found that 65 percent of likely voters in the Bay Area support the tax.

The number grew to 70 percent when arguments in favor were explained. But support varied widely. While 76 percent of Marin County voters, 71 percent of San Franciscans, 70 percent of Alameda County residents and 65 percent of Santa Clara County residents backed the idea, only 44 percent did in Napa County, 55 percent in Solano County, 61 percent in Contra Costa County, 62 percent in San Mateo County and 63 percent in Sonoma County.

Because the two-thirds requirement applies to the entire region, however, a large majority in one area could offset a lower margin in a different county.

Environmentalists say the measure is critical in helping fulfill long-term restoration plans around the bay. A study in October by more than 100 scientists, coordinated by the Coastal Conservancy and other organizations, found that 54,000 acres of wetlands -- an area twice the size of the city of San Francisco -- need to be restored around the bay in the next 15 years to provide protection from surging storms. The alternative is concrete sea walls, which can cost more and would turn the bay into a giant bathtub over time, with far fewer birds, fish and other wildlife, the report concluded.

Driven by melting ice and expanding warming water, the bay and the Pacific Ocean off California will rise up to 1 foot in the next 20 years, 2 feet by 2050 and up to 5 feet by 2100, according to a 2012 study by the National Academy of Sciences.

"This is the most important thing we can do for the bay," said David Lewis, executive director of Oakland-based Save the Bay. "There's an urgency to restore tidal marshes, for ecological benefits and flood control benefits. The sooner we start the sooner they can provide benefits. But money has been the missing ingredient for a long time."

Paul Rogers covers resources and environmental issues. Contact him at 408-920-5045. Follow him at Twitter.com/paulrogerssjmn.

RELATED: